- Economic and Policy Shifts: President Trump’s second term began with rapid changes, including 109 executive orders and significant tariff implementations (e.g., 25% on autos, steel, and aluminum, and 145% on China). These actions have been accompanied by increased economic uncertainty, impacting decision-making and market stability.

- Economic Resilience: The U.S. economy is approaching any potential economic soft patch from a position of strength, with healthy consumer debt ratios and a structurally tight labor market. Some European economies have also been roused from their slumber and are undertaking large and significant steps to increase defense and investment spending.

- Market and Technological Disruptions: The market was buffeted this past quarter, by not only changes emanating from the White House but also the emergence of DeepSeek’s AI breakthrough. Its arrival poses a potential challenge to the dominance of some of the major tech firms, which up to recently had looked impermeable.

- Global Trade and Financial Changes: President Trump is seemingly trying to move away from the Bretton Woods II system of exchange rates, which represents a major shifting of the tectonic plates of global trade and finance. Investors are advised to maintain a nimble and active approach to portfolio management as this process continues to evolve.

Policy modification and variability in economic levers are the trademark of new presidential and governmental changeovers. Since the inauguration of President Trump, he has issued 109 executive orders, far more than any president since 1950. The executive orders have been met with global market uncertainty centered on the impact from tariffs, taxes, DOGE (Department of Government Efficiency), deportations, and geopolitical unrest.

Tariffs have taken the main stage in the markets’ reaction and (at the time of writing) President Trump has introduced 25% tariffs on autos, steel, and aluminum, and a 10% baseline tariff on all countries. Global trade partners responded with reciprocal tariffs, which exposed the global markets to major moves in volatility, equity prices, currency fluctuations, and bond yields. The impact seemingly influenced a 90-day pause on many of the imposed tariffs, with the exception being China, where the administration raised the tariff to 145%.

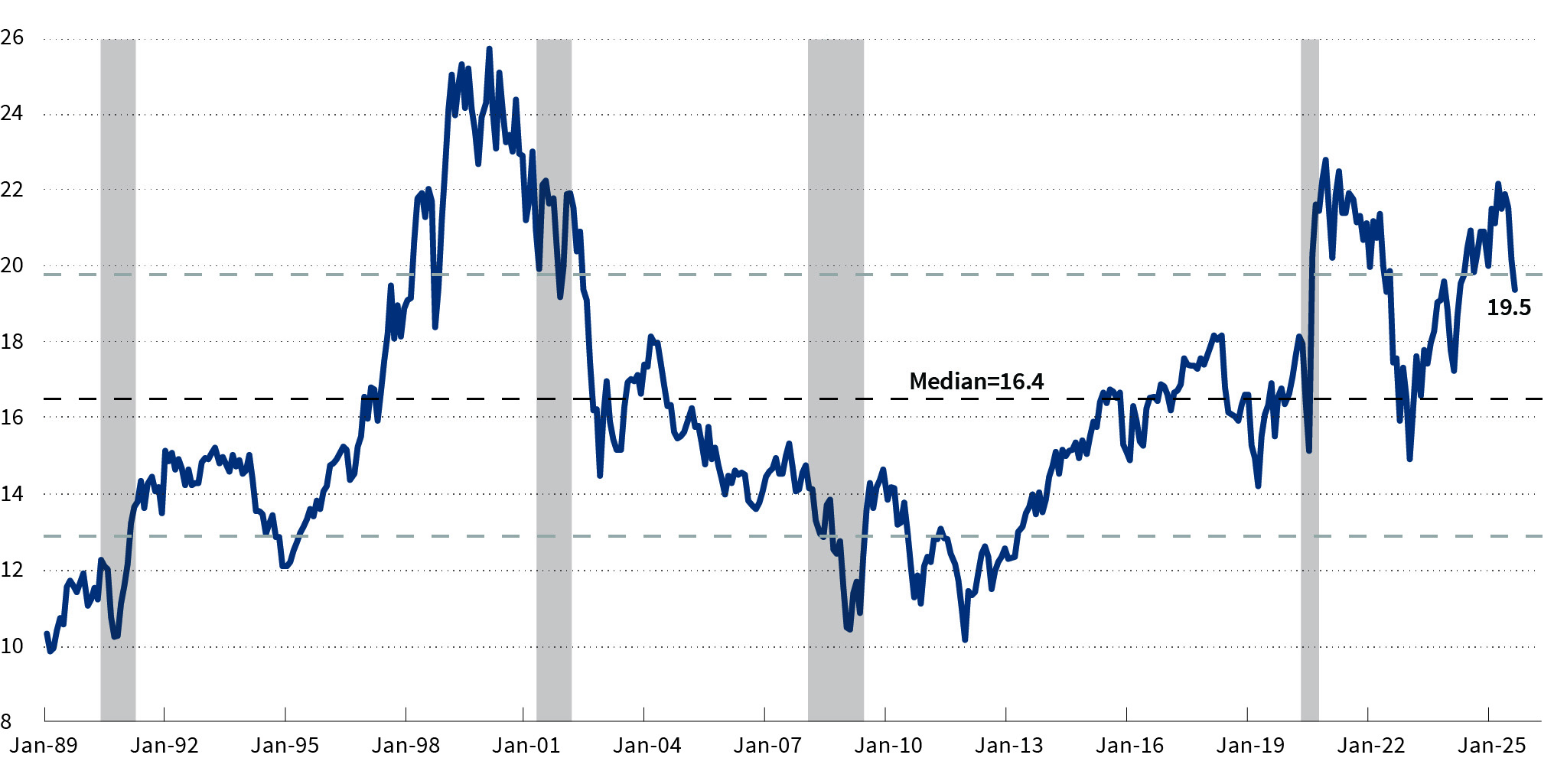

While the consumer, the market, and many companies are likely to be able to deal with 10% tariffs, what they are now struggling with is the uncertainty factor. These sectors of the economy are finding that without some consistency around where tariffs are going to be and for how long, it is very hard to make any kind of major decisions. This lack of clarity will likely take its toll in the coming months with a deceleration in economic activity as entities wait to see what happens. Investors, for their part, are also demanding a slightly higher equity risk premium as compensation for the uncertainty in the form of a lower P/E multiple (exhibit 1).

S&P 500 Forward P/E Ratio

Based on Mean Next 12 Months, Bottom-Up Estimates

Economic Growth and 2025 Uncertainty

If the economy is heading toward an economic soft patch, it is starting from a position of strength, in our view. Unlike ahead of the 2008 global financial crisis, the U.S. consumer has a strong balance sheet and recent consumption growth has been mostly income-driven as opposed to credit-driven spending. Meanwhile, households have been busy repairing and deleveraging their balance sheets since that crisis, with now very healthy debt ratios. Furthermore, due to slowing birth rates and an aging population, the labor market is also structurally tight, and this has been evident in a much-higher-than-expected employment participation rate. This is showing up in a reluctance by companies to let go of workers, as they may find it difficult to find such skilled labor again once the economy starts to reaccelerate. And, for those workers who could lose their jobs, they still have the skills, confidence, and contacts that should help them to be re-employed relatively quickly.

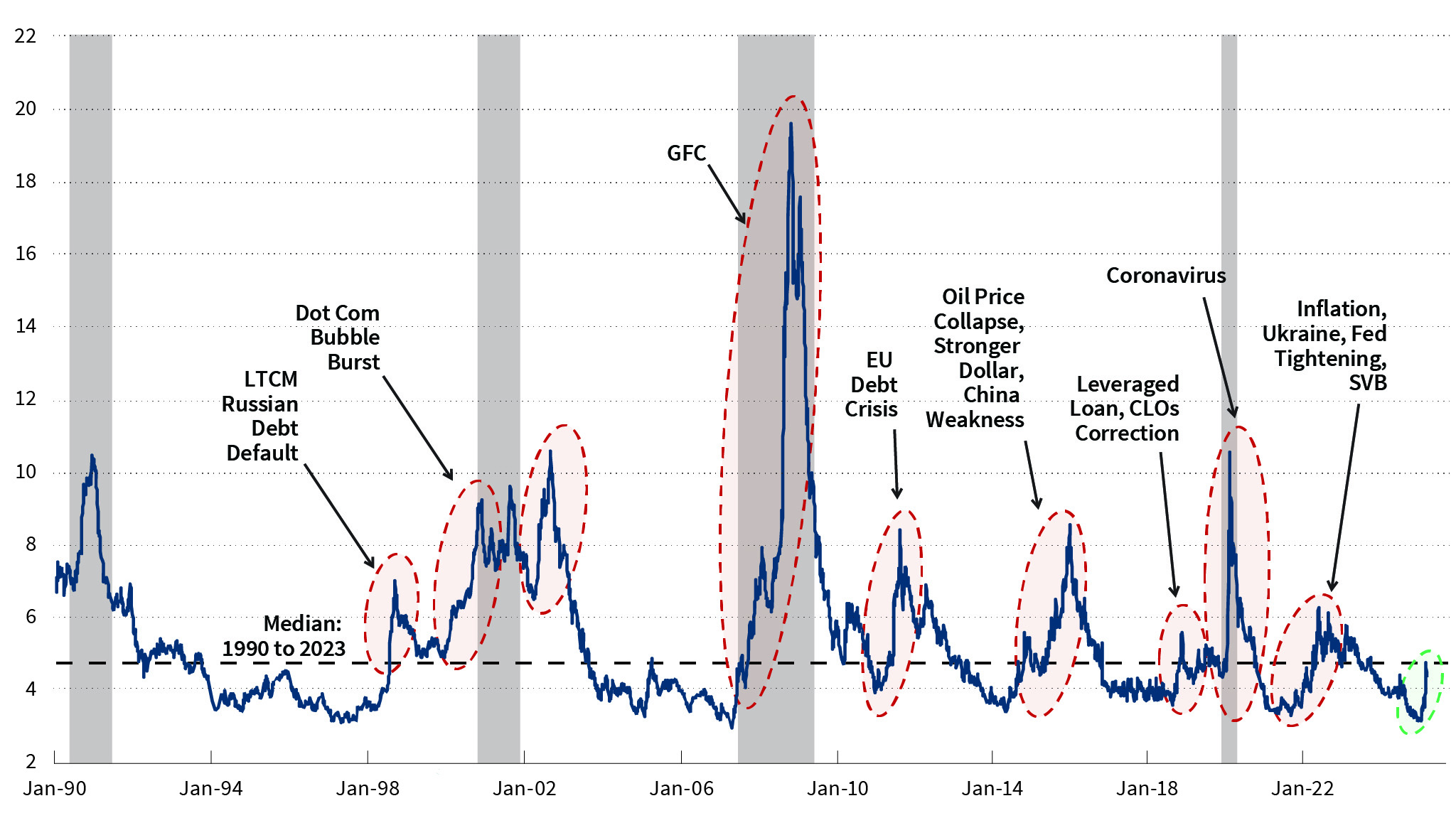

As for the corporate sector, high-grade corporate debt has performed well, and while lower-grade yield spreads—which are far more sensitive to economic conditions—have increased, so far these spreads have only just reached their historical average (exhibit 2). One of the upsides of this is that the private sector is in a position to respond to lower interest rates as a stimulative should the economy slow enough that the Fed needs to provide some extra rate cuts as support.

High Yield Credit Spread

ICE BofA High Yield Corporate Bond Yield Minus 10-Year U.S. T-Note Yield, %

However, not all of the market correction over the quarter can be laid at the door of tariffs. The market was also stunned earlier in the quarter with the announcement that a Chinese company, DeepSeek, with an investment of just $6 million, was able to closely replicate the output of OpenAI’s ChatGPT and other AI companies that had spent many billions of dollars developing their own products.

This cut right to the heart of what has been driving the market over the past year, the Magnificent 7, and it came with the clear message that money may not be the moat that the market thought it was when it comes to AI. Surprisingly, there was no immediate market reaction to DeepSeek’s announcement when it was released on Inauguration Day, January 20; rather, it took a full week before that happened. When it did sink in, however, we witnessed the largest one-day decline by market cap of any company in history, with Nvidia shedding $593 billion (or 17%) of its total market cap. For perspective, that is more than the entire market cap of Oracle, which at the time was the 15th-largest company in the S&P 500 index.

Meanwhile, the German government—in response to President Trump’s request for increased defense spending—agreed to a radical shake-up of its own fiscal regime, by suspending the debt brake and creating a €500 billion 10-year infrastructure and defense investment initiative. While such a shift should help to have a powerful multiplier impact on the rest of the economy and European Union, there is still much work that needs to be done.

The 19% surge in gold prices over the past quarter has also attracted a lot of investor attention. Much of the increase seems to be based on geopolitical tensions and the desire by central banks to add diversification to their reserve holdings.

The increase in gold prices is consistent with what is turning out to be a major regime change, or a shifting of the tectonic plates of global trade and finance. This comes in the form of President Trump’s decision to seemingly move away from the Bretton Woods II currency arrangement (a freely floating dollar, but still acting as the world’s reserve currency of choice) to an as-yet-undecided new system that will attempt to retain all the advantages of the so-called “exorbitant privilege” (soft power, control of the financial system, lower interest rates) while simultaneously shedding most of the disadvantages (larger trade and budget deficits, and an overvalued currency).

Ultimately, the message to investors from this past quarter is that the world is now changing. Many of what we thought were entrenched systems of trade and finance are in flux; how significantly is still up in the air and will depend on the reaction going forward from this new regime’s stakeholders—domestic U.S. citizens and the corporate sector, as well as foreign economies and financial markets. As a result, we should continue to anticipate market volatility, and crucially in these circumstances, maintain a nimble and active approach to portfolio management. Over the long term we believe we are at the start of transition back toward greater diversification across the equity market, including across the small- and midcap space, as returns from the traditional safe havens such as bonds provide more variable support.

| Index | YTD | 1Q | 1Y | |

|---|---|---|---|---|

| S&P 500 | U.S. Large Cap | -4.27% | -4.27% | 8.25% |

| DJIA | U.S. Large Cap | -0.87 | -0.87 | 7.40 |

| Russell 3000 | U.S. All Cap | -4.72 | -4.72 | 7.22 |

| Russell 2000 | U.S. Small Cap | -9.48 | -9.48 | -4.01 |

| MSCI EAFE | Developed International | 6.86 | 6.86 | 4.88 |

| MSCI EM | Emerging Markets | 2.93 | 2.93 | 8.09 |

| Bloomberg U.S. HY | U.S. High Yield | 1.00 | 1.00 | 7.69 |

| Bloomberg U.S. Agg | U.S. Core Bond | 2.78 | 2.78 | 4.88 |

| Bloomberg Muni | U.S. Muni Bond | -0.22 | -0.22 | 1.22 |

| MSCI U.S. REIT GR | U.S. Real Estate | 1.07 | 1.07 | 10.26 |

Total Returns

Source: FactSet