After a hot start to the year, the leveraged loan market sparked a heat wave just in time for summer with volumes climbing to near-record levels. Pricing contraction across the market fueled a frenzy of refinancing Q2 activity, and as demand heavily outweighs supply, lenders are being forced to concede on pricing and other key terms to win new deals. With spreads at multi-year lows and overall sentiment continuing to improve, investors anticipate even more borrower-friendly conditions in the back half of the year.

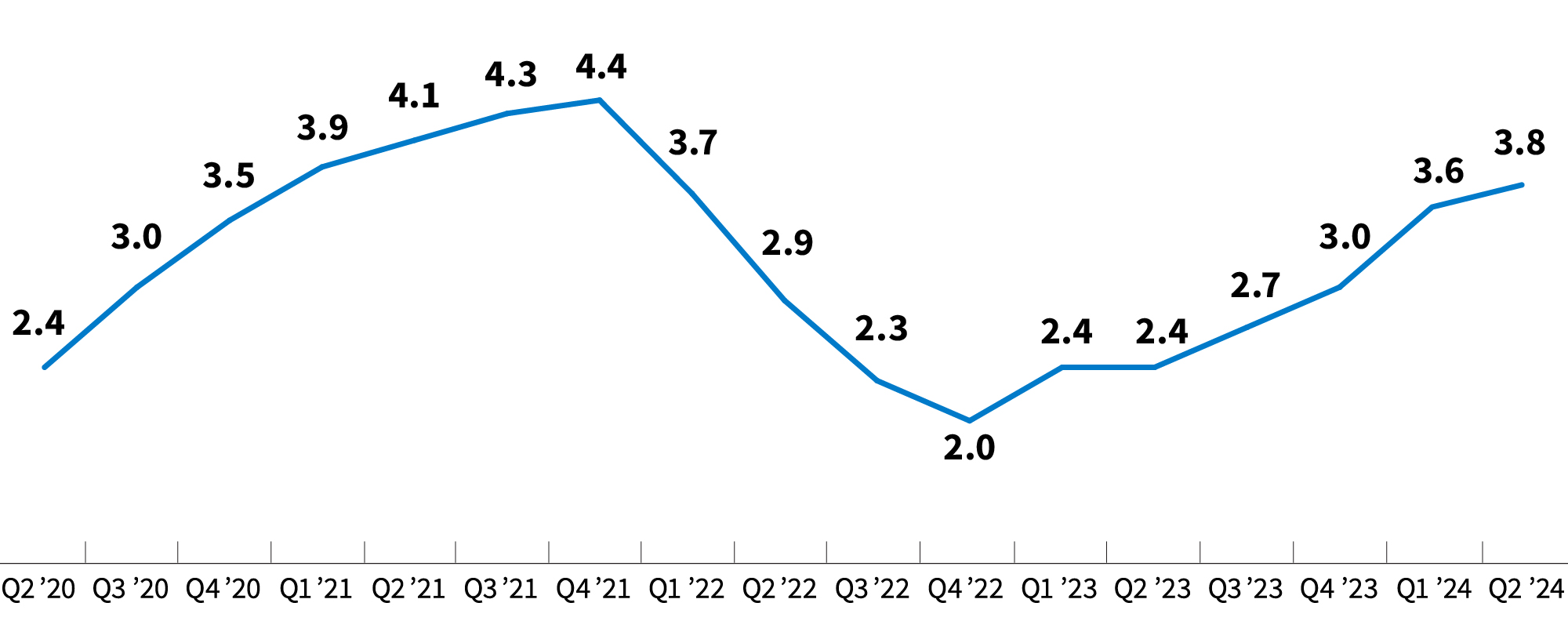

William Blair Leveraged Lending Index

Each quarter we ask middle-market lenders to rate overall conditions in the leveraged finance market on a scale of 1 to 5, with 5 being the most borrower-friendly conceivable.